Finance Transformation

Mobilizing more and better education investments

The Commission is collaborating with countries, multilateral development banks, and partners around the world to mobilize more and better investment in education. The International Finance Facility for Education (IFFEd) is an innovative education financing mechanism that aims to unlock up to US $10 billion of new funding by 2030, to help get every child in school and learning.

What is the International Finance Facility for Education?

The International Finance Facility for Education (IFFEd) is a powerful new financing engine for global education. It is specifically designed to tackle the education crisis in lower-middle-income countries (LMICs) which are home to 80% of the world’s children.

IFFEd is a recommendation of the Education Commission, put forward in The Learning Generation report released in September 2016. IFFEd complements existing grant instruments like the Global Partnership for Education (GPE) and Education Cannot Wait (ECW) and fills a critical gap in the international financing architecture for education. By using a combination of catalytic grants and guarantees and multiplying scarce donor resources by a factor up to seven, investing in IFFEd will enable international donors to help close the massive education financing gap in LMICs without reducing their existing support for education in low-income countries or humanitarian settings.

Closing the gap in education financing

Funding for education is more important than ever. The world is in the midst of an unprecedented global crisis as a result of COVID-19 that will be felt for generations. Before the emergence of COVID-19, the education of the world’s children and youth was already in crisis – 260 million children were out of school and more than 550 million were in school but not learning the basic skills needed to thrive.

The COVID-19 pandemic has magnified the world’s learning crisis exponentially. According to UNESCO, more than 1.6 billion children and youth – over 90 percent of the world’s student population – had their education disrupted due to school closures in more than 190 countries.The scale and speed of this disruption was unparalleled, and the worst impacts will be felt by the poorest and most vulnerable, especially girls, for years to come. Unless we act now, learning losses will translate into significant long-term challenges, including lower labor market participation and significantly lower future earnings.

The poorest and most marginalized children are at the greatest risk. The worst impacts of the crisis will be felt by the most vulnerable, especially girls, refugees, and those living in extreme poverty. A child who is out of school for more than a year is unlikely to return, and girls are 2.5 times more likely to drop out. Without being in school, millions of children could be trapped as laborers, child brides, soldiers, and victims of human trafficking and modern slavery. Without an education, an entire generation of future doctors, teachers, lawyers, and entrepreneurs will not be able to realize their full potential and contribute to the recovery and growth of their communities.

The special challenge of lower-middle-income countries (LMICs). Fifty LMICs are home to more than half of the world’s children and youth (more than 700 million), the largest number of out-of-school children, and the largest number not learning of any income group. This includes some of the most populous countries such as India, Indonesia, Kenya, Nigeria, and Pakistan. Even under the most optimistic scenarios of increased domestic budgets and more efficient spending, LMICs will face a financial shortfall to address these challenges, likely rising to 80 percent of the total global financing gap by 2030. Despite large and rising financing needs, international development assistance has not kept pace with need. Total global aid for education is currently only around US$12 billion – roughly $10 per child – barely enough to pay for a secondhand textbook. Indispensable programs such as the Global Partnership for Education (GPE) and Education Cannot Wait (ECW) are not designed to address LMICs’ large long-term financing needs and are already stretched focusing on LICs or emergency humanitarian needs. By maximizing scarce donor resources in an unprecedented way, IFFEd allows donors to better meet the financing needs of LMICs at an affordable cost, without having to reduce allocations to LICs or for humanitarian crises.

A new way to finance education

IFFEd runs on a basic set of principles:

Efficiency: Harness the power of the multilateral development banks (MDBs) – the African, Asian, and Inter-American Development Banks, the European Bank for Reconstruction and Development, and the World Bank – to mobilize additional financing in capital markets and implement programs. IFFEd requires no new actors at the country level.

Scale: Multiply traditional aid up to seven times, double existing investments from banks, and mobilize up to US$10 billion of new investments in education in its first few years of operation.

Affordability: Soften loan terms to make them more affordable and manageable for educational investment.

Sustainable financing for results: Align investments with education sector plans, encourage countries to mobilize domestic funds for education and manage their debt responsibility, and deliver results.

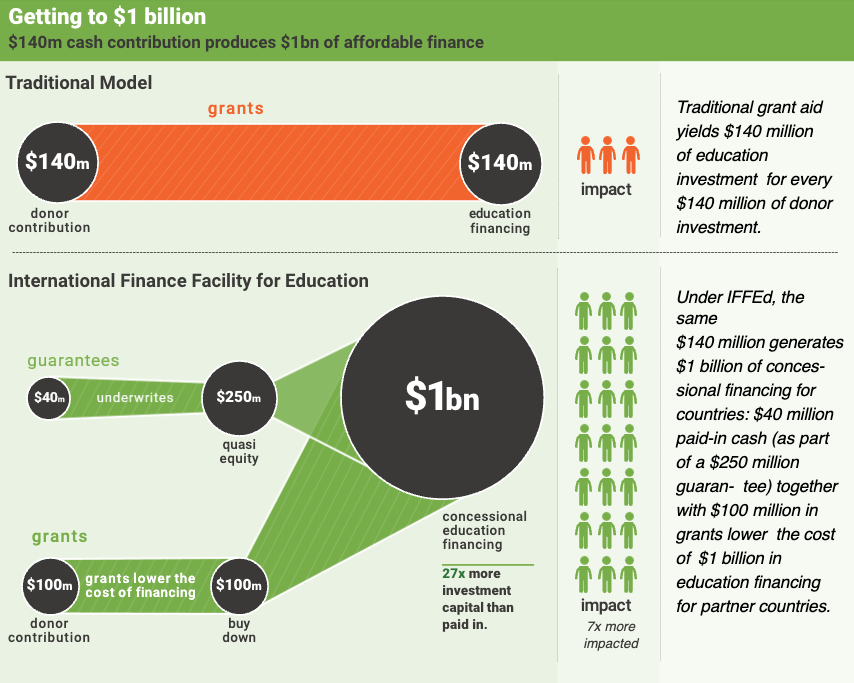

Maximizing the impact of donor dollars

IFFEd offers a game-changing model. It uses guarantees and grants from contributors to generate increased education financing by the MDBs and reduce lending terms for borrowers. IFFEd has two funding windows:

Grants: IFFEd will provide grants to participating MDBs to lower the cost of their education financing to eligible countries. These grants allow LMICs to borrow for education on more affordable terms and encourage them to invest in education.

Guarantees: IFFed will guarantee loan repayments to MDBs from their client countries, effectively providing MDBs with a form of capital which they can leverage four times on the capital markets. Donors only need to provide 15 percent of total commitments to this window up front in cash, with the remaining 85 percent provided in the form of a contract to convert commitments to cash if needed to maintain the financial stability of IFFEd.

Country commitment: Countries will only be eligible to access this new financing if they have:

- A credible education sector plan

- A commitment to improving education opportunities for marginalized children, consistent with the ‘leave no one behind’ principle

- A commitment to increase its domestic education budget to meet international standards

- A capacity to sustain additional MDB debt, as demonstrated by a debt sustainability analysis

- A growing integration of results-based performance targets (consistent with the Paris Declaration on Aid Effectiveness)

How does IFFEd work?

IFFEd is not an implementing agency. It will work by enabling participating MDBs to increase the amount and affordability of funding for education in LMICs. The fundamental premise of the MDBs’ financing models is that they can borrow and then lend, at low rates, a multiple of their capital base to countries due to their AAA rating. The guarantees provided to IFFEd by donors, treated as quasi equity, allow the MDBs to further expand their lending to an estimated $4 for each $1 of guarantees.

IFFEd aims to mobilize up to $10 billion in additional international finance towards achieving SDG 4 by 2030. Its initial fundraising target is $1 billion for the guarantee window ($150 million in cash and $850 million in contingent commitments) and $1 billion for the grant window. This will deliver a total of $5 billion in new education finance in its first five-year programming period.

Steps are underway to establish IFFEd and its small administrative unit so it can be fully operational in 2022 as called for by the UN Secretary-General in his Our Common Agenda report.

- Save the planet, transform education

- Historic first-ever International Finance Facility for Education (IFFEd) launched at United Nations Transforming Education Summit

- Around 3 in 4 youth lack skills needed for employment, new report says

- Deputy Secretary-General echoes call to operationalize International Finance Facility for Education to drive education transformation

- The World Skills Clock: A new real-time data and advocacy tool for SDG 4

The International Finance Facility (IFF): A proposal to maximize MDB balance sheets in the short to medium term ›

A paper on the IFF – the innovative guarantee model developed by the Education Commission

IFFEd Explainer ›

Learn more about this public-philanthropic partnership and why joining this alliance is a smart investment to supercharge education financing

Statements of Support ›

Diverse leaders from around the world support IFFEd.

Financing for the EdTech Ecosystem working

paper ›

Read this innovative finance working paper prepared for the December 2021 RewirEd Summit

Financing for the EdTech Ecosystem executive summary ›

Read the 3-page summary of the working paper prepared for the December 2021 RewirEd Summit

IFFEd Prospectus 2020 ›

Learn about the current design of this powerful new engine for global education

IFFEd and Debt Sustainability Brief ›

Read about IFFEd’s impact on debt sustainability in LMICs

IFFEd and COVID-19 Brief ›

Read how IFFEd can mitigate the pandemic’s impact on learning.

2020 IFFEd Update ›

Read the latest update on the Facility’s development.

Draft IFFEd Results Framework ›

Read IFFEd’s initial set of proposed monitoring and results indicators

IFFEd Strategic Case ›

Read the note prepared during the design process with the evidence that makes the case for IFFEd

Design Proposal with Technical Annexes ›

See the details of how the Facility’s business model will work.

IFFEd at a glance

- Substantial new financing and bold reforms are required to help lower-middle income countries (LMICs) make significant progress towards achieving SDG4. LMICs are home to 80% of the world’s learners, who are being left behind.

- IFFEd can help countries mitigate the impacts of COVID-19 by providing a new, affordable stream of education finance in the face of declining revenues and increasing budgetary constraints.

- IFFEd will help LMICs close the financing gap by utilizing the financial leverage of MDBs and guarantees from contributors to maximize the impact of donor dollars.

- IFFEd offers significant value for investment. Compared to traditional grant aid, IFFEd will provide low-cost finance that can benefit seven times more children and youth for the same grant contribution.

- IFFEd fills a critical gap in the international financing architecture for education, complementing existing instruments like GPE and ECW.

- Nearly 50 countries have the potential to benefit from IFFEd, including some of the world’s most populous countries with large marginalized populations, such as Bangladesh, Indonesia, Pakistan, Kenya, and Nigeria.